Executive Summary:

International equity markets, as represented by the MSCI EAFE Index, delivered a notable gain of 4.8% for the third quarter.

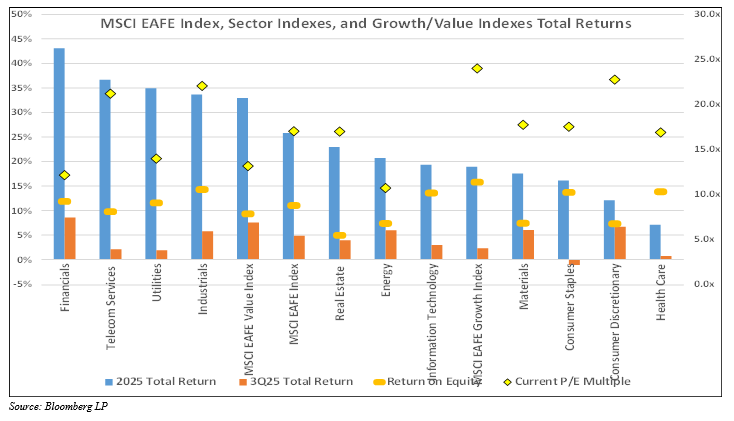

Value stocks outperformed growth stocks, continuing a multi-year rotation favoring value cohort. Over the last two years quality stocks underperformed, reversing their historical trend towards outperformance over longer term horizons for this factor exposure.

A valuation gap persists between the US and international equities, and currency movements alone contributed 12.1% of the 25.8% USD return year-to-date for the MSCI EAFE Index.

The Financial sector led performance again this quarter, while Health Care and Consumer Staples lagged, as risk appetite increased.

Forecasting economic estimates remains difficult due to policy uncertainty, trade barriers, inflation pockets, weaker labor market, and geopolitical tensions.

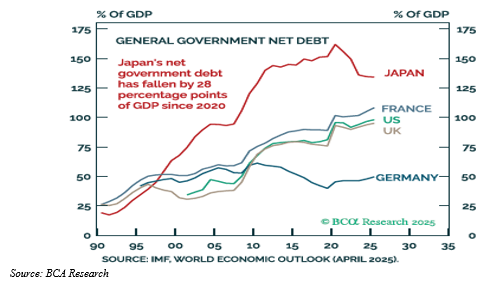

UK and France face fiscal imbalances and budget constraints, restraining fiscal flexibility. Germany removed its debt brake, enabling some fiscal stimulus, offsetting some of the fiscal constraints from their European peers.

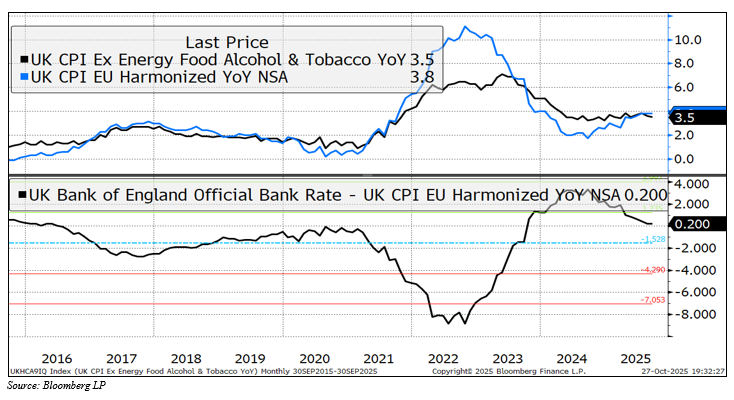

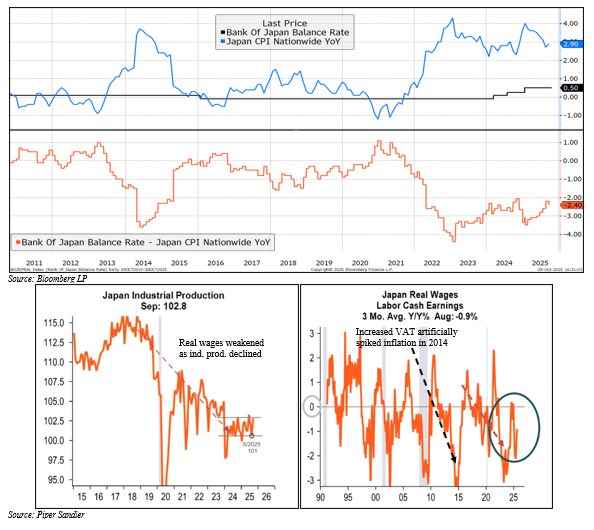

Persistent inflation in Japan and the UK limits monetary policy flexibility. Labor markets have posed unique challenges with France and Canada with increased unemployment rates, while Japan maintain low unemployment but weak real wage growth, impairing consumption.

Policy rates have declined globally, but long-term rates remain elevated, potentially limiting credit growth.

Economic and Capital Markets Commentary

The international markets, as represented by the MSCI EAFE Index, returned 4.8% during the third quarter. After a volatile second quarter with significant drawdowns in April followed by explosive rebounds from lows, the third quarter grinded along closer to a trend line. The greatest single-day drawdown was only 2.1% during the third quarter versus 3.9% during the second quarter when “Liberation Day” prompted an abrupt market reaction.

The overall trend during the quarter benefited value within the broader market. The MSCI EAFE Value Index outperformed the MSCI EAFE Growth Index by approximately 5.2% during the quarter. The surge in value perpetuated a trend from prior quarters. Quality companies, as measured by the MSCI EAFE Quality Index, also underperformed the broader MSCI EAFE Index by 2.6% during the quarter. This “Quality” Index is designed to measure the performance of “quality growth stocks” within the broader Index, focusing on high return on equity, stability of earnings growth, and low financial leverage. The bid for lower quality index constituents reflects capital flow dynamics as expectations for a European economic recovery and less favorable sentiment for US investment assets prompted a reallocation of capital.

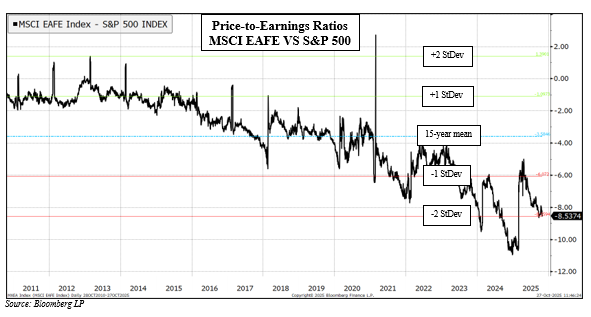

Despite the rotation during the year, the valuation gap between the domestic S&P 500 Index and the MSCI EAFE Index actually widened during the quarter, belying the underlying strength and highlighting the impact of currency. The forward price-to-earnings ratio (see chart below) for the broad index remains, statistically, at the low end of a fifteen-year range. The discount sits at two standard deviations below the mean. Theoretically, some discount to valuation multiples is warranted, as both EPS growth rates and return on equity are generally lower for developed markets outside of the United States, contributing to lower total price returns over longer horizons. This recent, wide gap may continue to provide an attractive entry for investors interested in maintaining direct exposure to international equities, diversifying currency exposure, and managing geopolitical risks, despite the significant contribution from sudden moves in currency markets earlier in the year.

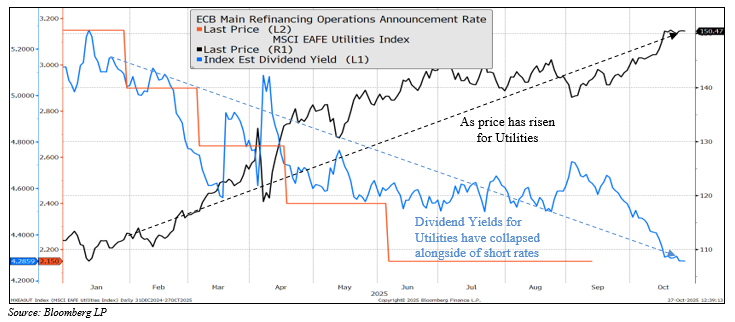

The Financial sector continues to be the strongest performing sector for the year and quarter. A declining interest rate environment contributed to price support for high dividend sectors, such as Utilities and Communication Services, and the chart below exhibits how Utilities closely serve as a bond proxy, with dividend yields moving in tandem with rate policy.

The weakest sector for the year, Health Care, has historically been considered defensive, along with Utilities and Communication Services. This sector suffered from idiosyncrasies after COVID, and despite precarious economic conditions, the sector lagged sectors more directly geared towards lower rates and steepening yield curve. The weakness in Consumer Staples this quarter, another defensive sector, reflects an increased risk appetite from market participants, as well as a weaker consumer after inflation impact. Consumer Discretionary lagged during most of the year but was the second-best, sector-level performance for the quarter. An improvement in economic and industrial activity, resulting from both monetary and fiscal action, should stimulate future discretionary consumer spending as employment and wage outlook improve.

The United Kingdom continues to suffer from a weak economic sentiment and outlook. The annual rate of real GDP growth slowed to 1.4% annualized rate during the second quarter, and monthly data from July shows prospects for lower growth for the third quarter. The UK manufacturing PMI fell to a 5-month low of 46.2 in September before rebounding in October. The unemployment rate continues to trend higher, hitting a cyclical high of 4.7% – up from lows of 3.6% in 2022. A decline in job openings also reflects this weaker employment picture, and total job openings remain below pre-pandemic levels. This challenging environment comes as headline inflation remains persistently high, rising to 3.8% during September. Services prices continue to remain elevated, largely resulting from rises in administered prices (government regulated prices for electricity, taxes/duties, water, healthcare, etc).

This inflationary wave should peak around 4%, before declining through 2026. The Bank of England needs inflationary risks to reverse and trend towards their 2% target to provide an opening for further cuts to policy rates to stimulate activity. Existing budgetary deficits put at risk any Keynesian, fiscal response to weaker activity. The Parliament, controlled by the Labour Party, has blocked attempts to narrow deficits through cost controls, and raising taxes (again) appears to be their preferred route to bridge the gap. This combination of monetary and fiscal constraints makes the U.K. unlikely to experience strong economic growth over the next few quarters. Most estimates for real GDP growth are 1.1-1.3% in both 2025 and 2026 with no consensus for an acceleration into 2026.

Euro area GDP decelerated dramatically over the last few quarters with second and third quarters growing only 0.1%, sequentially. The current growth rate equates to an estimated 0.9% annual real GDP growth, potentially slowing from the annual 1.5% rate in the third quarter. The region appears to be avoiding a technical recession, but growth is tepid and uneven. While inflation has ticked up a bit, the EU Harmonized Index of Consumer Prices (HICP) rose 2.6% in September. This lower level of inflation has enabled the European Central Bank to lower rates by 235bps since last June, and they have reentered negative real rate territory, which should provide an expansionary, credit impulse for the coalition economies. Net fiscal impulse is less clear due to various state budgets. On one side, France is currently struggling with a deep political crisis tied to its budget crisis. Their budget deficit is around 5.4% (percentage of GDP), while public debt continues to climb. Both the deficit and debt exceed levels permitted by the European Union, requiring austerity that would likely be more economically restrictive. Alternatively, Germany has benefitted from a more disciplined budget and, now, has the ability to lift their debt brakes to provide stimulus into their economy. According to their proposal to Brussels in September, the deficit is expected to grow from currently ~2% to 3.8% in 2026 before trending towards 1.9% target in 2029.

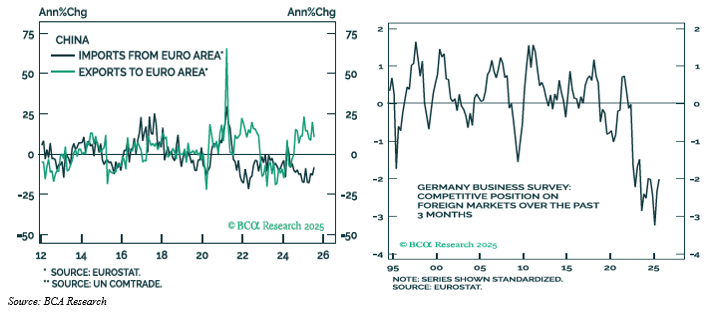

The more expansionary policy, where available, holds promise for acceleration of real growth in GDP, but the current revision trends have tempered earlier expectations. The World Bank has lowered its expectations for economic growth for the European Union from ~1.5% to 1.1% for 2025. While domestic consumption has recovered from annual declines in prior years, external demand and import levels have weighed on GDP measures. Germany is particularly exposed, as Chinese imports of goods, including onslaught of autos, have found Europe to be a market for excess supplies resulting after tariffs impede access to the US market. Chinese imports into the EU were up 11% from prior year in July, yet EU’s exports to China fell by 8%. Across the region, banks remain very well capitalized, and with accommodative monetary policy, lending has started to increase modestly. A credit impulse will likely be key to stimulating growth in 2026, as few major European economies have fiscal space for additional spending. The World Bank still expects European Union real GDP growth to accelerate to 1.5% in 2026.

Japan is experiencing a gradual recovery phase, but momentum is weakening. Soft domestic demand, rising import costs, and reduced exports have contributed to this weaker outlook. The Bank of Japan continues to wrestle with the emergence of inflation. Real rates remain in deeply negative territory and present a risk, as any rise in inflation would cause real rates to fall further into negative territory, weakening prospects for the yen. The recent election of Japan’s first female Prime Minister, Sanae Takaichi, brings a renewed embrace of Abenomics, promoting easier fiscal and monetary policy, which could contribute to risks to the yen. Despite these downside risks, the yen remains undervalued relative to other currencies on a purchase price parity basis. Private consumption remains weak in real terms despite some nominal gains, and household savings rates have increased. While consumers have balked at spending on consumer durables, business investment has been resilient, driven by labor shortages and stable earnings. Real capital investment has grown for four consecutive quarters, as companies address challenges of an aging population, prompting greater investments in productivity and automation. Real GDP should grow at ~0.6% in 2025, rising modestly to 0.8% in 2026. Japan also faces the challenge of stimulating growth without undermining monetary discipline and purchasing power.

Australia continues to maintain a resilient labor market, though employment edged down in September. The unemployment rate trended to 4.4%, rising 30bps from the prior year. Despite this increase, the labor market appears stronger than Commonwealth peers Canada or the UK. The Purchasing Managers’ Index for Manufacturing Activity fell slightly into contractionary territory, though Composite Index remained at expansionary levels supported by services activity. The Reserve Bank of Australia has cut rates three times during 2025 to support growth into 2026, and while inflation remains subdued, further rate cuts are expected.

Canada experienced weakening fundamentals and policy pressure. Growth has been stalling, as estimates for monthly growth in real GDP rose just 0.2% in July, following three consecutive monthly declines. Preliminary data indicate negligible growth in August, confirming absence of any momentum. Unemployment rate rose to 7.0%, rising from cycle lows of 5.0% set in late 2022. Housing markets in Canada remain weak, despite aggressive rate cuts. The Bank of Canada has reduced policy rates from 5.0% to 2.5% over the last 18-months. Offsetting this expansionary monetary policy, the trade disputes with the US have disrupted exports to a market historically representing 75-80% of total Canadian exports. Exports to the US fell by 27% between January and August, impacting many industries. Weak growth, housing fragility, and labor market fragility cast a shadow over this economy.

Overall, the global economy is expected to grow in both 2025 and 2026, but the growth rates could vary widely. Some markets suffer from weaker data but have limitations as to the scope of potential responses due to either elevated inflation or fiscal imbalances. Over the past eighteen months, some economies suffered from recessions – namely, Germany – but now have ample fiscal scope to complement more accommodative measures from the European Central Bank. These measures will be welcome as they now face increased pressures around Chinese imports and weak competitiveness. So, while the rising tide should provide buoyancy to all markets, the strength of the economic response may be governed by the scope of available fiscal and monetary policy.

Mason D. King, CFA

November 5, 2025