The U.S. economy remains remarkably resilient. Growth has surprised to the upside for much of the year, while the labor market has softened marginally, and progress on lower inflation has stalled. Against this backdrop, the Federal Reserve Bank began easing monetary policy in September to manage downside risks while hoping to avoid stoking inflation. Following a spike in initial unemployment benefit claims several weeks ago, both initial and continuing claims have begun to decline, reflecting relatively limited layoffs. This has created what Federal Reserve Chairman Jerome Powell calls a “curious balance” in the labor market, where the supply of labor and demand for labor are falling simultaneously.

Beyond labor market headlines, steady consumer spending and technology-heavy capital expenditures have underpinned strong corporate earnings growth. Leading indicators of business activity, including the ISM Services Index and several regional Federal Reserve manufacturing surveys, have delivered upside surprises in recent months.

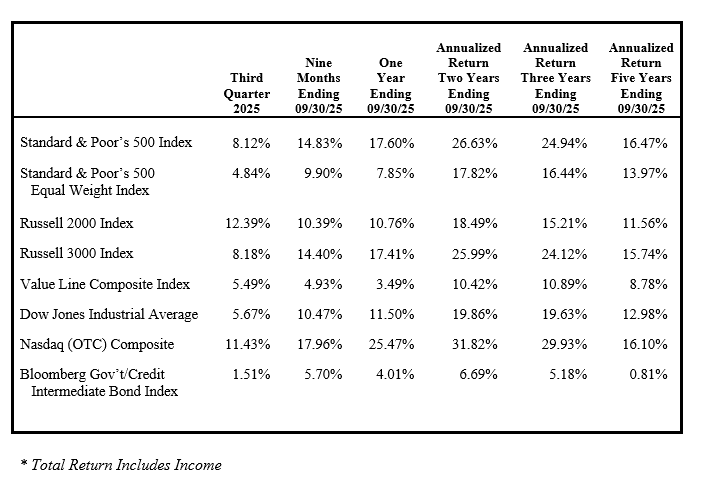

Investors have faced a long list of concerns this year, starting with tariffs, rising geopolitical tensions, inflation, signs of labor-market strain, soft housing data, and now a government shutdown. Despite a sharp market pullback earlier this year with drawdowns of 20% for the Standard & Poor’s 500 Index, 25% for the NASDAQ, and 30% for the Russell 2000, each of these indices reached all-time highs in the third quarter. Market leadership remains concentrated, with the ten largest companies in the Standard & Poor’s 500 Index accounting for 40% of the index value, surpassing the 32% peak reached in 1964. Better-than-expected corporate earnings growth for the largest companies has been a major driver of those gains and has contributed to elevating market concentration.

Looking ahead, the combination of monetary easing, ongoing fiscal and regulatory initiatives, and legislated pro-business accounting changes could further bolster economic growth. Policy tailwinds may provide incremental support to areas that have lagged, such as housing, manufacturing, and specific segments of the labor market. If growth expands beyond the largest technology companies, equity participation could become more widespread across a broader range of industries.

ECONOMY

The Federal Reserve lowered its benchmark interest rate by 0.25% at its September meeting, setting the target range at 4.00 to 4.25%. Chairman Powell framed the move as a “risk management cut,” intended to support a softening labor market. The three-month moving average gain in nonfarm payrolls has slipped to roughly 29,000, which is well below the 111,000 monthly job gains the Federal Reserve Bank of Atlanta estimates would be needed to prevent unemployment from rising, assuming labor supply remains unchanged. Part of the slowdown reflects a reduced labor supply, amid significantly less immigration and an increase in deportations.

Nonfarm Payrolls 3-Month Average Net Change

Source: Bloomberg, BLS

August’s unemployment rate rose to 4.3%, a new cycle high. Survey measures of job availability have weakened, with more respondents reporting that jobs are difficult to find. The ratio of job openings to unemployed workers fell below 1.0 in July for the first time since 2021, and the net hiring is increasingly concentrated in less cyclical sectors, such as health care.

Many interest-sensitive parts of the economy, especially housing, respond more to medium- and long-term interest yields than the Federal Reserve’s short-term policy rate. Those longer maturities are less directly influenced by current Federal Reserve action. Indeed, when the central bank reduced the Federal Funds rate by 1.0% from September through December of last year, the yield on the 10-Year Treasury Note rose by a similar amount, driven by stronger growth, persistent inflation concerns, and heavier government borrowing. These forces largely remain and could limit declines at the long end of the yield curve.

Inflation is a mixed bag. The Federal Reserve’s preferred inflation gauge, core Personal Consumption Expenditures (PCE), ran at 3.0% in July and August, well above the 2.0% goal. Even so, price pressure has been milder than many feared in the wake of tariffs announced on “Liberation Day” in April. Services remain the primary source of stickiness. On the goods side, many firms have hesitated to pass through tariff costs, fearing a loss of market share, and some have pulled orders forward ahead of tariff implementation. As those companies replenish their inventories, tariffs are likely to affect new orders. Therefore, we would not be surprised to see goods inflation tick up modestly.

Economic activity continues to remain strong. The second-quarter real GDP (SAAR) was recently revised upward from 3.3% to 3.8%. Crucially, consumption—the core of the economy—was revised higher from 1.7% to 2.5%. Retailer surveys in September suggest real consumer spending could accelerate in the third quarter. Despite two softer payroll reports, consumers appear to remain resilient, particularly high-income households whose net worth is expected to rise about 9.0% in the third quarter, supported by gains in home values and investment portfolios.

In the fourth quarter, growth may cool, labor data may stay choppy, and inflation could edge higher. Even so, markets are likely to look through near-term disappointments toward 2026, when easier monetary policy and fiscal support from the One Big Beautiful Bill are expected to improve growth, hiring, and inflation dynamics.

MARKETS

The current bull market turns three years old in October, and this cycle has been unusual in several ways. Most notably, it is rare for a bull market to gain the tailwind of monetary easing when the bull is already in full stride. As a result, looser monetary policy coincides with a new high-water mark in equity prices, home values, bitcoin, gold, and money supply. Credit spreads remain at near-historic tight levels, signaling bond investors’ confidence in the outlook. Until recently, however, both businesses and consumers had been notably downbeat, based on sentiment surveys. The Federal Reserve projected a 0.75% reduction in interest rates, including the September cut, which is expected to help lift sentiment among firms and households. With the Atlanta Federal Reserve tracking 3.8% real GDP growth for the third quarter, matching the second quarter’s pace, investors are right to ask, “How much additional stimulus does the economy actually need?”

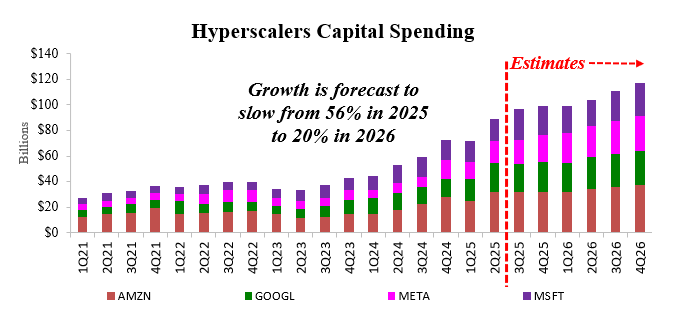

AI remains the centerpiece of the U.S. growth story, but poses a strategic dilemma for cloud and AI model leaders. First movers race to secure scarce inputs, such as state-of-the-art chips and the power to run them, because constrained supply becomes a strategic asset, and allowing rivals to corner inputs raises future costs. The penalty for falling behind is steep. AI model training and inferencing attract data, applications, and developers; if those workloads settle on a rival’s clouds, the rest of the customer’s software stack may follow. Meanwhile, model tooling, safety, evaluation, and fine-tuning advance fastest where usage is densest, creating a network effect for the leaders.

The result is a capital spending super-cycle by the “hyperscalers” of cloud computing: Meta, Amazon, Microsoft, and Alphabet, who are on pace to spend nearly $400 billion this year. That arms race contrasts with their historically capital-expenditure-light, free-cash-flow-rich models, which favor large buybacks. We expect each to be free cash flow positive in 2025, although Amazon will only be marginally positive. At today’s growth rate, capex is unlikely to be sustainable without tapping debt, and it is unclear how far these firms will commit not only current but also future cash flows in the pursuit of AI leadership.

Source: Wolfe Research, LKCM

Open-source models and rapid innovation increase the likelihood of another step-change, thereby raising the risk that incremental dollars invested earn diminishing returns. As scrutiny shifts from cost savings to durable monetization, investors will focus more on revenue-generating cases.

Market concentration is now higher than at any point in over 150 years, with the market value of the top ten stocks in the Standard & Poor’s 500 Index representing over 40% of the index. The previous modern peak was in 1964, when the top ten accounted for 32%. There is a key difference in composition. The early 1960s leaders spanned diverse sectors – AT&T, Standard Oil of New Jersey, General Motors, General Electric, DuPont, IBM, Eastman Kodak, Coca-Cola, and Procter & Gamble – rather than a single investment theme like AI. Today, seven of the top ten are closely tied to AI: NVIDIA, Microsoft, Alphabet, Amazon, Meta, Broadcom, and Tesla.

In our view, market concentration functions much like valuation – it serves as a gauge of risk, rather than a near-term timing tool. Elevated valuations do not by themselves predict a downturn, but they can increase the downside when a bear market arrives. Similarly, extreme market concentration does not forecast the next move, yet it implies greater vulnerability if leadership stumbles. It also means that index returns depend heavily on a handful of companies, which are linked mainly to one another today. Thematic concentration increases the correlation between these companies and amplifies idiosyncratic risks, which are now present in the largest weights in the index.

A tight commercial loop underscores this concentration and risk. OpenAI has announced a $100 billion commitment to purchase Oracle products and services. Oracle, in turn, has committed $100 billion to NVIDIA GPUs. NVIDIA has announced a $100 billion investment in OpenAI. In essence, OpenAI pays Oracle for computing; Oracle buys NVIDIA hardware to deliver it; NVIDIA both supplies systems and invests back into OpenAI. While not our base case, history shows that excessive capital investment can end poorly. Today’s announcements echo elements of Cisco Systems’ late-1990s vendor-financing cycle, which turbocharged revenue from $2 billion to $19 billion. Propelling Cisco Systems to the most valuable company in the world in March 2000, before falling 78% over the following twelve months as order cancellations and excess inventory weighed on the company.

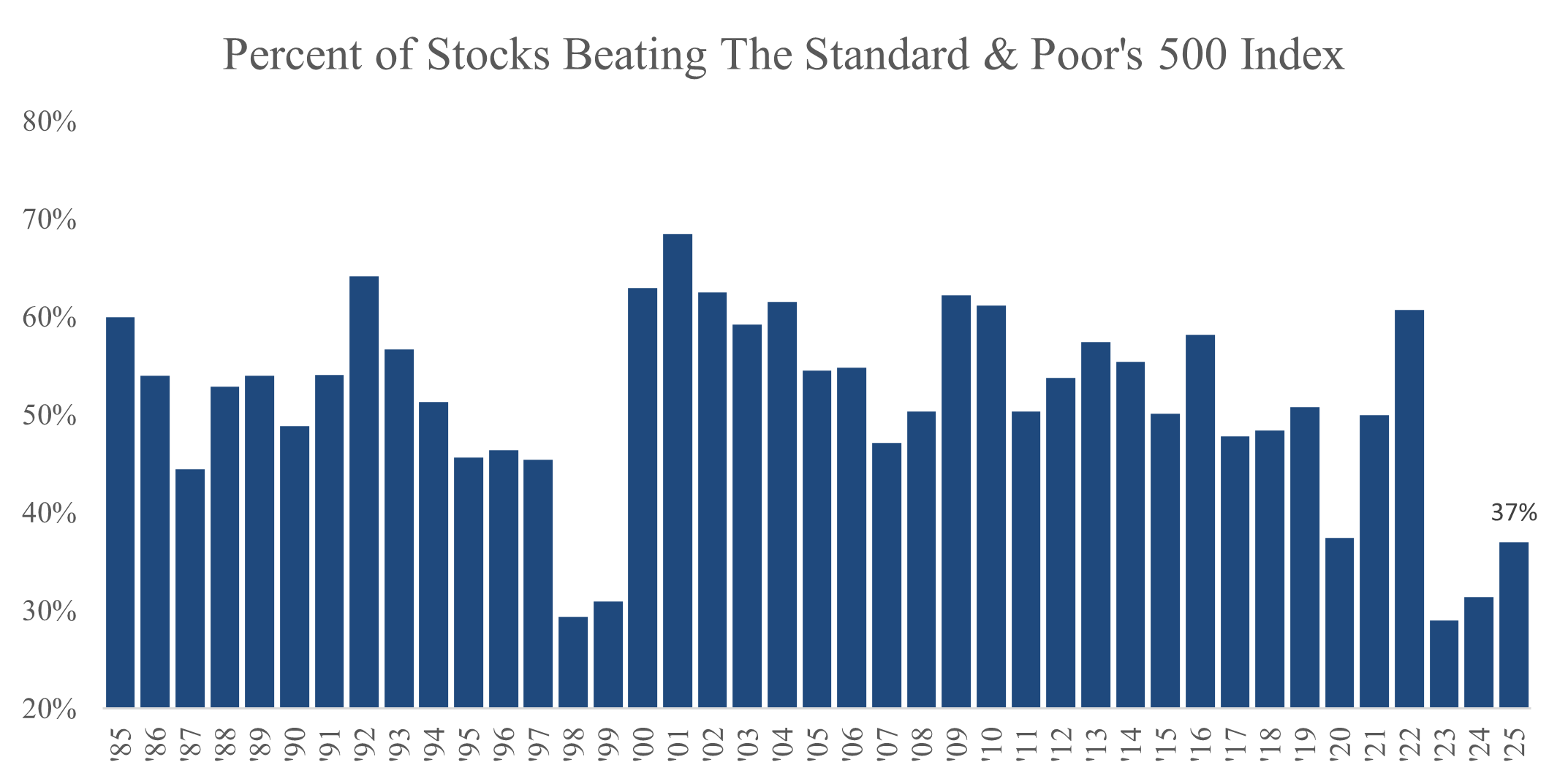

Market leadership has re-narrowed. After broadening in the first quarter, the top ten stocks in the Standard & Poor’s 500 Index now account for over 40% of the index’s value, a new high this cycle. And only 37% of the index constituents are ahead of the benchmark year-to-date, a historically low percentage.

Source: Piper

CONCLUSION

Second-quarter GDP growth was revised up to 3.8% from 3.3%, led by stronger personal consumption. At the same time, hiring has slowed in recent months, and the unemployment rate has risen to its highest level since August 2021. This divergence in strong economic growth and a flagging labor market is curious and likely explained by two dynamics. First, elevated business uncertainty has prompted a hiring pause; however, we expect this to ease as trade policy clarifies. Second, early AI adoption may be increasing productivity, thereby boosting growth relative to the population employed and hours worked. The weaker employment picture also gives the Federal Reserve room to cut rates, which should support confidence and help sustain the economic expansion.

September was another strong month for markets, as the Standard & Poor’s 500 Index, Dow Jones Industrial Average, and Nasdaq set new record highs. Short-term rates fell as the Federal Reserve resumed cuts at its mid-month meeting, and markets expect two additional reductions by year-end. Even with the risk of rising inflation, softer employment, and slower fourth-quarter growth, investors are likely to look through near-term noise toward anticipated fiscal and monetary tailwinds in 2026.

FINANCIAL MARKET TOTAL RETURN*

Michael C. Yeager, CFA

October 6, 2025

IMPORTANT INFORMATION

The commentary set forth herein represents the views of Luther King Capital Management and its investment professionals at the time indicated and is subject to change without notice. The commentary set forth herein was prepared by Luther King Capital Management based upon information that it believes to be reliable. Luther King Capital Management expressly disclaims any responsibility to update the commentary set forth herein for any events occurring after the date indicated herein or otherwise.

The commentary and other information set forth herein do not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor do they constitute investment advice or an offer to provide investment advisory or other services by Luther King Capital Management. The commentary and other information contained herein shall not be construed as financial or investment advice on any matter set forth herein, and Luther King Capital Management expressly disclaims all liability in respect of any actions taken based on the commentary and information set forth herein.