LOOKING BACK AT 2024

Key capital market themes for the past year include resilient economic growth, a strong labor market, sticky inflation, a monetary policy pivot, and elevated fiscal spending. Despite entering 2024 with tight monetary policy, the U.S. economy showed surprising strength, with Gross Domestic Product (GDP) growth exceeding expectations, supported by robust consumer spending and industrial output. The labor market remained tight, with historically low unemployment and steady wage gains, though signs of cooling emerged later in the year. Inflation, while declining from its peak, proved stubbornly high in core categories, prompting policymakers to rethink the path of future interest rate cuts. Meanwhile, torrential fiscal spending added complexity to the economic landscape.

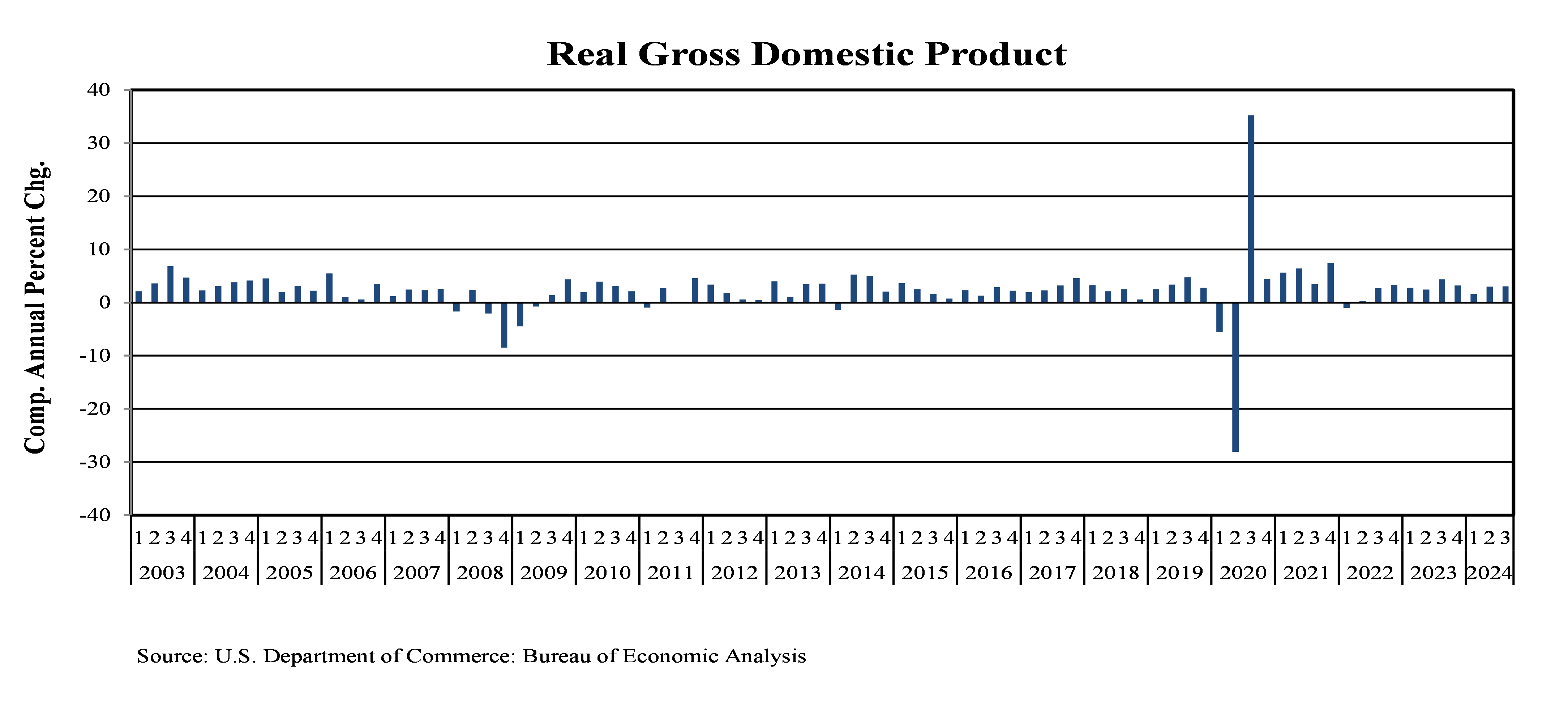

In the first quarter, real GDP expanded at an annualized rate of 1.6%, below many forecasts. The significant drivers of below-forecast growth were foreign trade and inventories, which clipped growth by nearly 1.5%. Real GDP growth accelerated to 3.0% in the second quarter, driven by strong consumer spending and resilient business investment, as businesses began to rebuild inventories after drawdowns in the first quarter. The momentum continued into the third quarter, with real GDP posting a 3.1% annualized gain as inflation pressure moderated and the Federal Reserve reduced interest rates for the first time this cycle. Consumer spending surged at a 3.7% pace in the third quarter, the fastest in 18 months, which likely persisted into the final quarter of 2024.

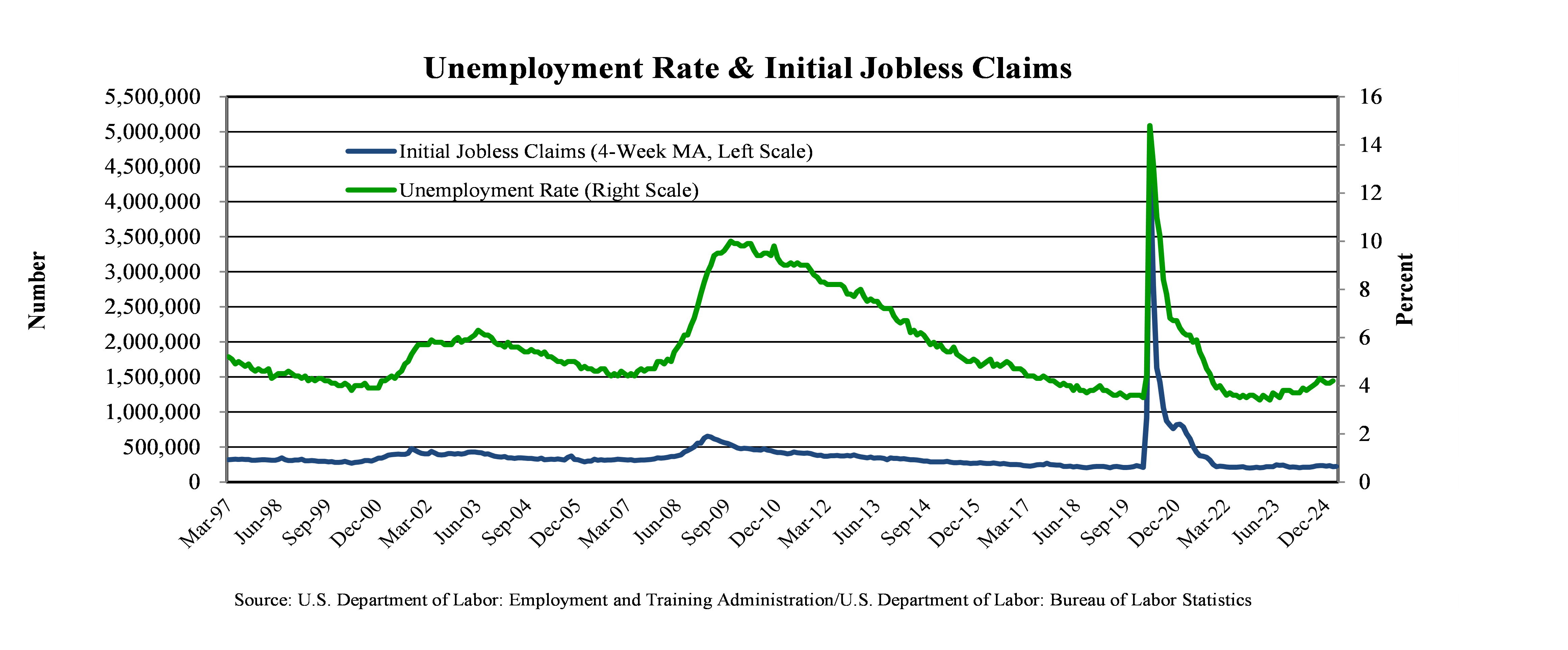

A strong labor market continued to fuel the economic expansion in 2024. Even as business hiring moderated, the unemployment rate remained at only 4.2% through November, though marginally higher than 3.7% at the end of 2023. The imbalance between job openings and available work has recently narrowed, signaling a more balanced labor market. There were 7.7 million job openings in October, compared to 7.1 million unemployed individuals. Importantly, wage growth exceeded the inflation rate for the past year.

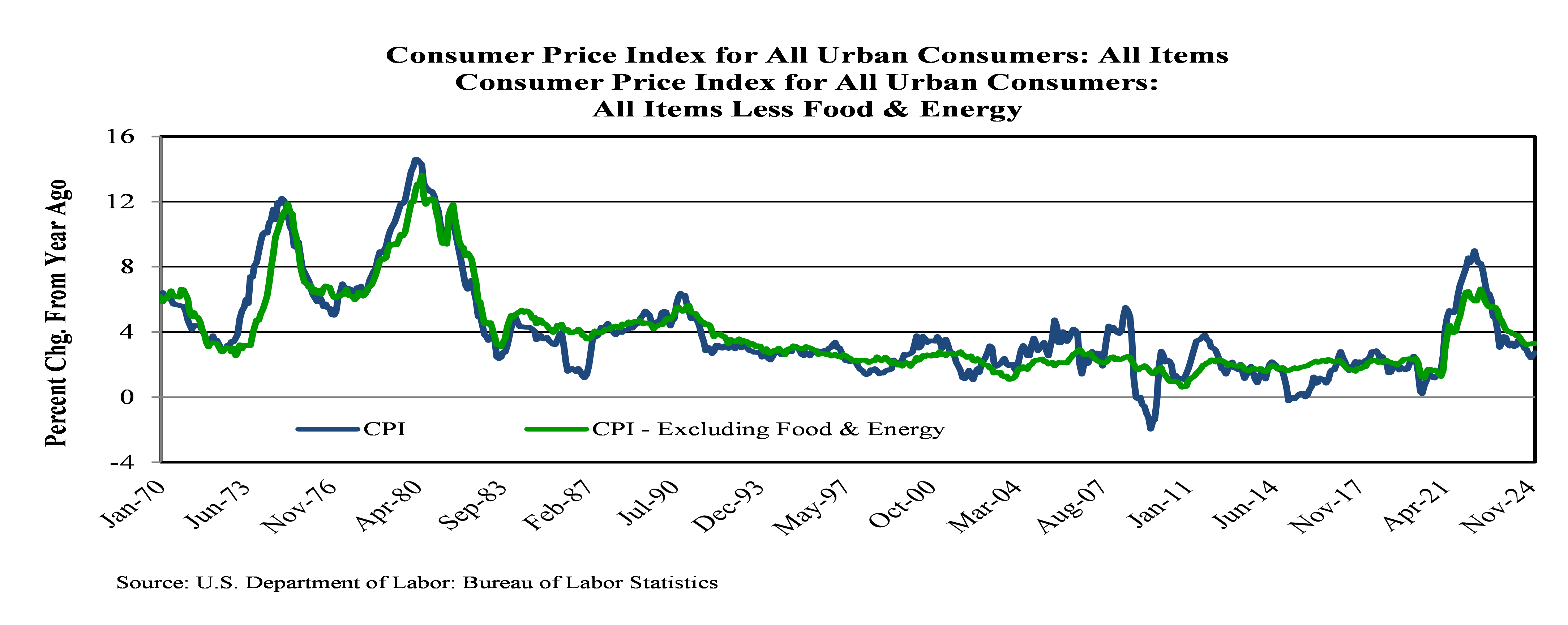

Inflation moderated through the first three quarters of 2024 but remained persistent in key sectors and above the Federal Reserve’s 2.0% target. The central bank’s preferred inflation gauge, Personal Consumption Expenditures, showed inflation falling to 2.4% through November, down from 2.7% at the start of the year. On a 12-month basis, goods prices have fallen 0.4%, but services have risen 3.8%, maintaining the elevated core inflation.

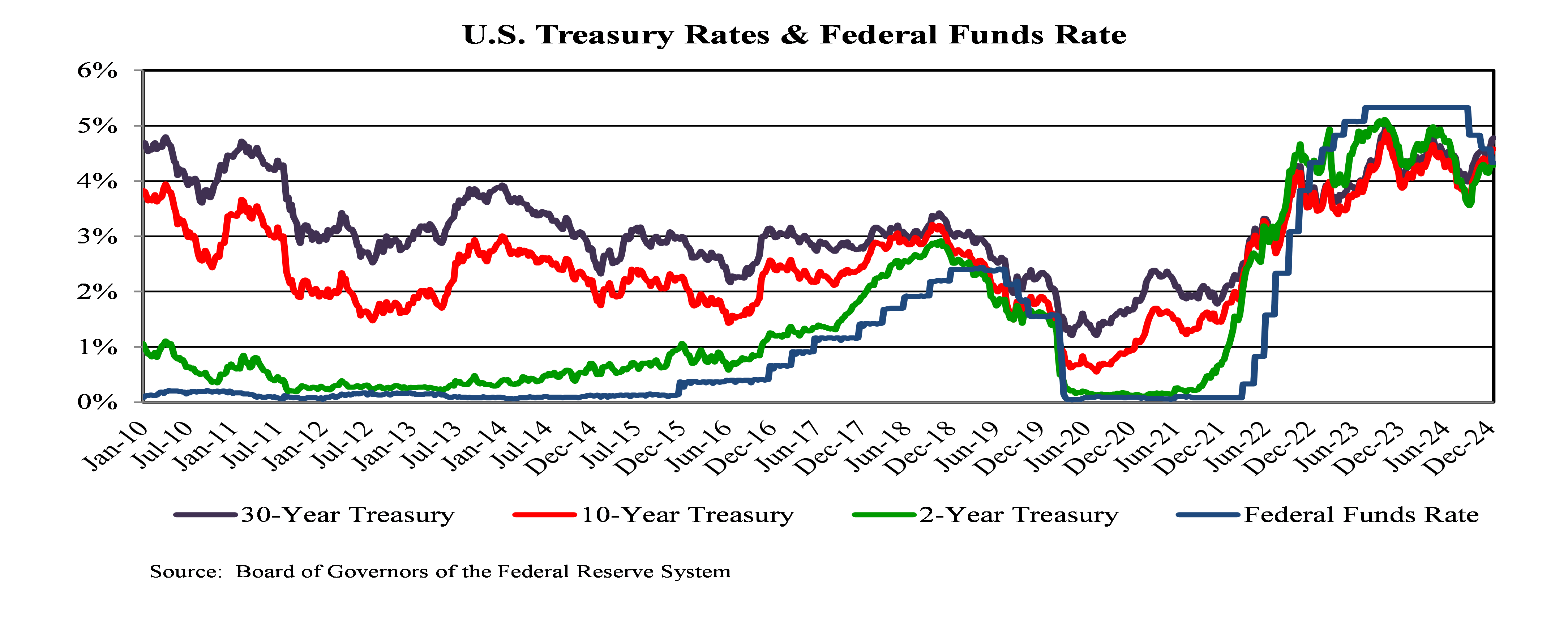

The Federal Reserve shifted its monetary policy stance in 2024. Prior to September 2024, the central bank was focused on reducing inflation with its corollary impact of reducing economic growth, raising interest rates from nearly 0% to 5.5%, and holding them there for over a year. However, the Federal Reserve implemented a 0.50% interest rate cut in September, followed by additional 0.25% cuts in November and December.

In 2024, we saw another year of significant federal deficit spending, adding to already mounting federal debt. Conventionally, federal budgets should be counter-cyclical, meaning government spending rises in times of economic lethargy and falls in times of economic plenty. Therefore, the counter-cyclical nature of budgets should resemble the rise and fall of unemployment. Indeed, over the past half-century, deficits averaged 2.4% of GDP when unemployment was low (less than 6.0%) compared to 5.0% deficit spending when unemployment was high. Although the unemployment rate averaged 4.0% in 2024, the deficit totaled 6.7% of GDP. U.S. fiscal policy has become procyclical.

Deficit spending increased federal debt held by the public from 35% of GDP in 2007 to 99% at the end of the government’s 2024 fiscal year. Much of this resulted from the 2008-09 Global Financial Crisis and from the pandemic. The heavy borrowing did not apply upward pressure on bond yields because inflation was very low. However, given the recent bout of inflation and concurrent higher interest rates, deficit spending will likely remain elevated for the next several years due partly to interest expense, which now exceeds the largest discretionary budget item, defense spending.

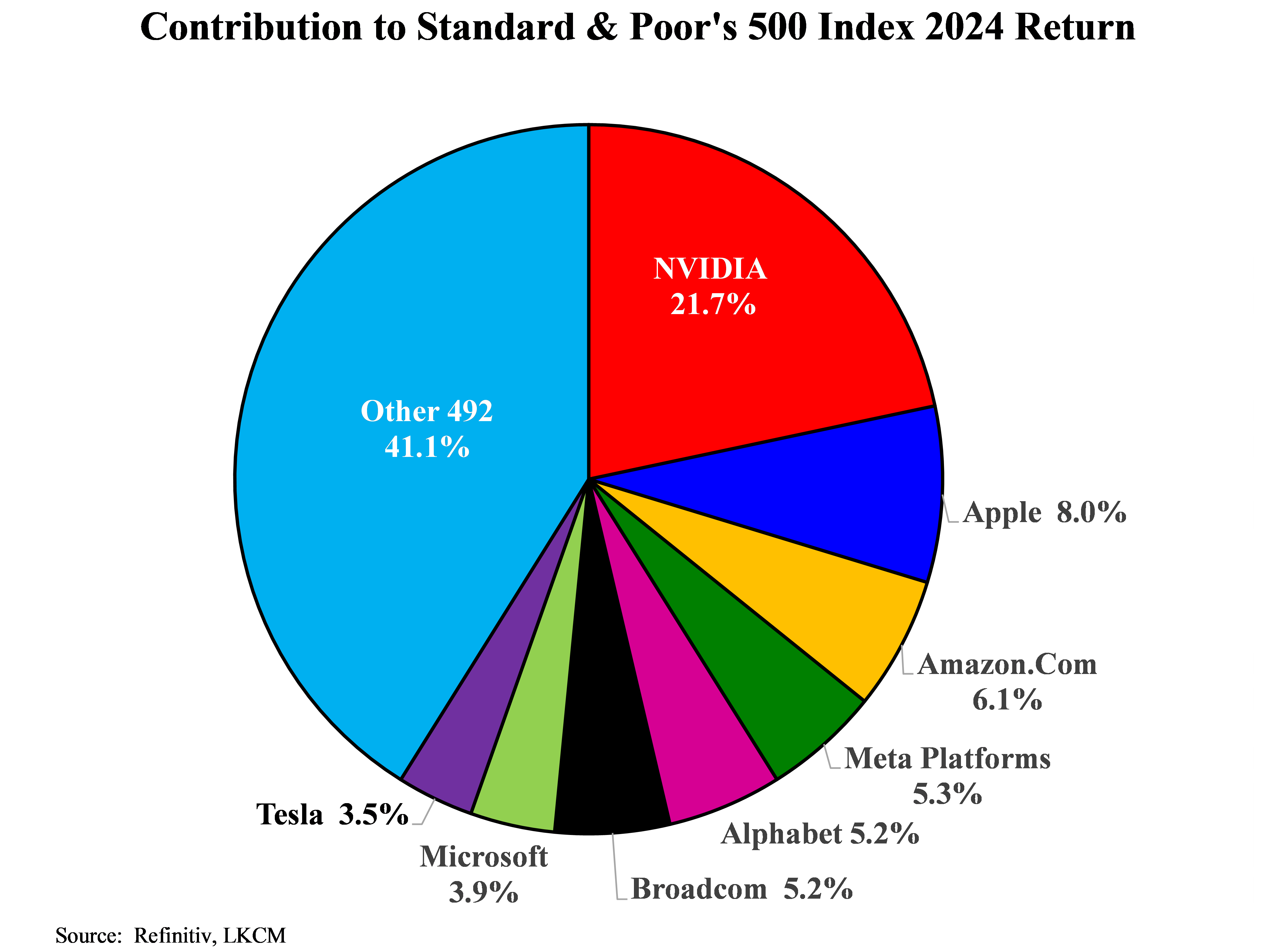

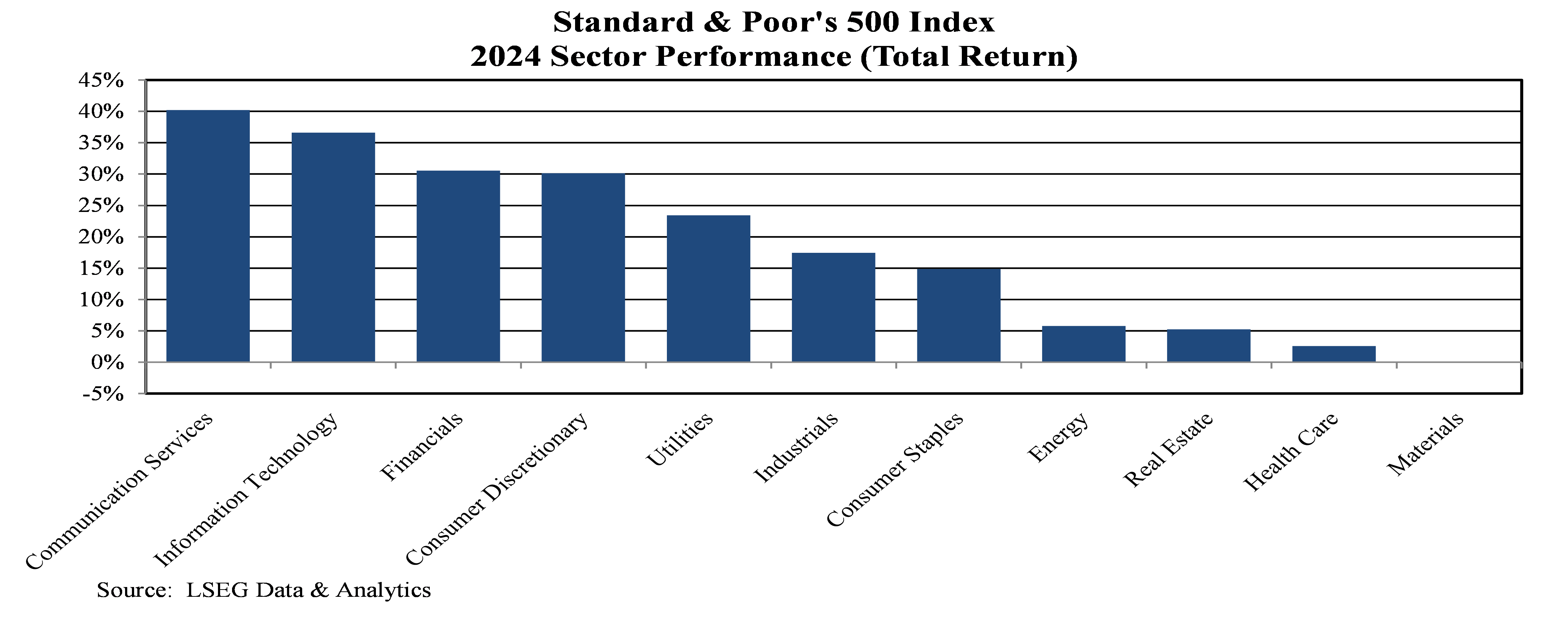

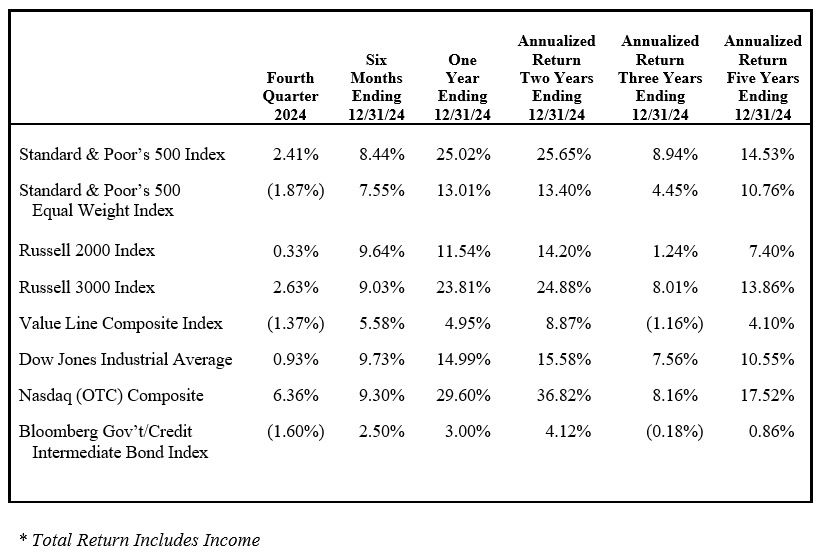

Moderating inflation, strong corporate earnings growth, and expectations of interest rate cuts from the Federal Reserve generated a tailwind for the U.S. equity market. The Standard & Poor’s 500 Index returned 25.0% in 2024. However, stock market concentration has been the greatest in 60 years, with just a few technology stocks driving most of the index returns. As a market capitalization-weighted index, the eight largest companies (Apple, NVIDIA, Microsoft, Amazon.com, Meta Platforms, Tesla, Alphabet, and Broadcom) in the Standard & Poor’s 500 Index represent 36.0% of the index and accounted for 58.9% of the return in 2024, as illustrated on the following page.

The market return for 2024 would have been 14.7% without the contribution of the eight largest stocks in the Standard & Poor’s 500 Index, similar to the Dow Jones Average return of 15.0%. If the Standard & Poor’s 500 Index were equally weighted, the return would have been 13.0% for 2024.

Two pivotal events have driven the sharp rise in market concentration since 2020. First, during the pandemic, investors were initially drawn to companies with strong balance sheets, high recurring revenue streams, and solid cash flow. These characteristics were present in many technology companies, which were also beneficiaries of “work-from-home.” Then, in 2023, the same mega-capitalization companies benefited from a new wave of innovation: generative AI. The launch of ChatGPT ignited global interest, spurring a surge of investment in infrastructure necessary to support large language models.

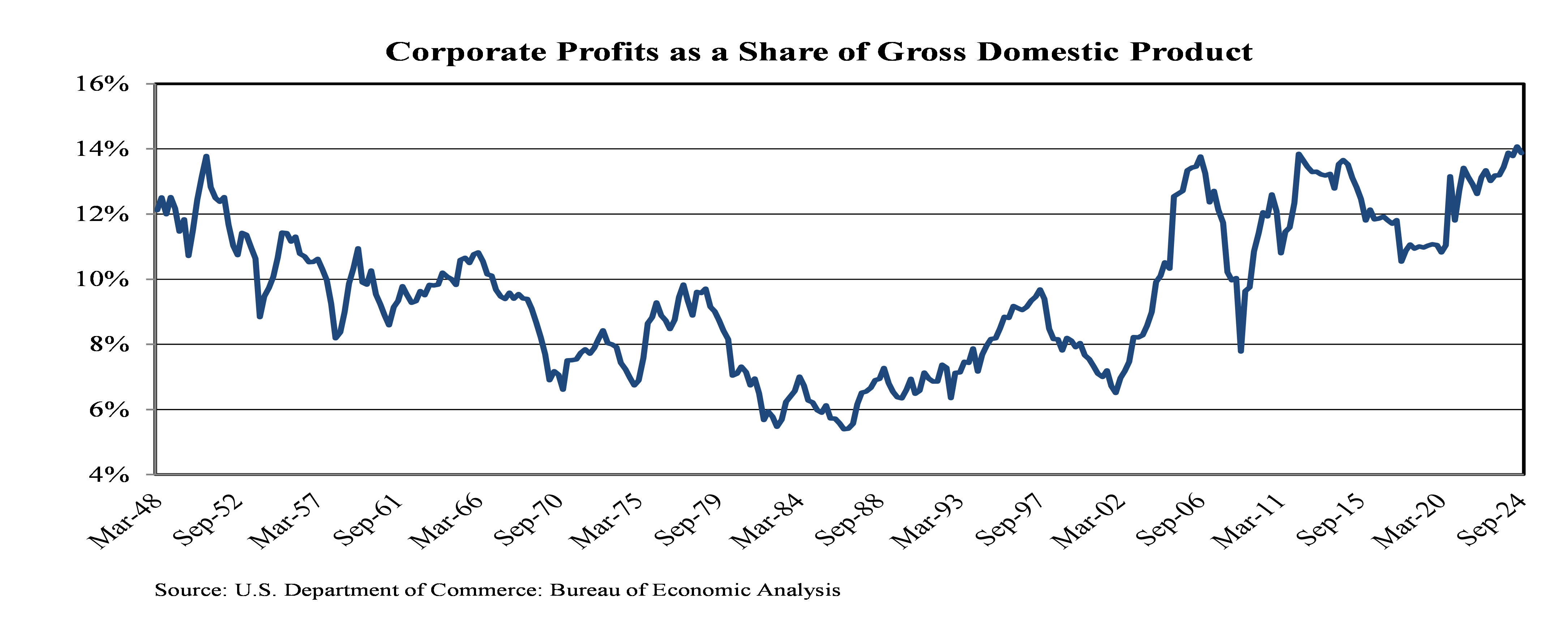

In the past, a steep rise in market concentration and narrow leadership has always reversed, with the Standard & Poor’s 500 Equal Weight Index outperforming the market cap-weighted index. For example, following the prior period of market concentration in 1998 and 1999, the Standard & Poor’s 500 Equal Weight Index outperformed its market-cap-weighted brethren in each of the ensuing seven years. We would anticipate a similar pattern again this cycle. There is no specific concentration level that equity indices should naturally gravitate toward because market valuations are ultimately tied to economic fundamentals. Over the long-term, it becomes difficult for companies to defend outsized economic profits sustainably.

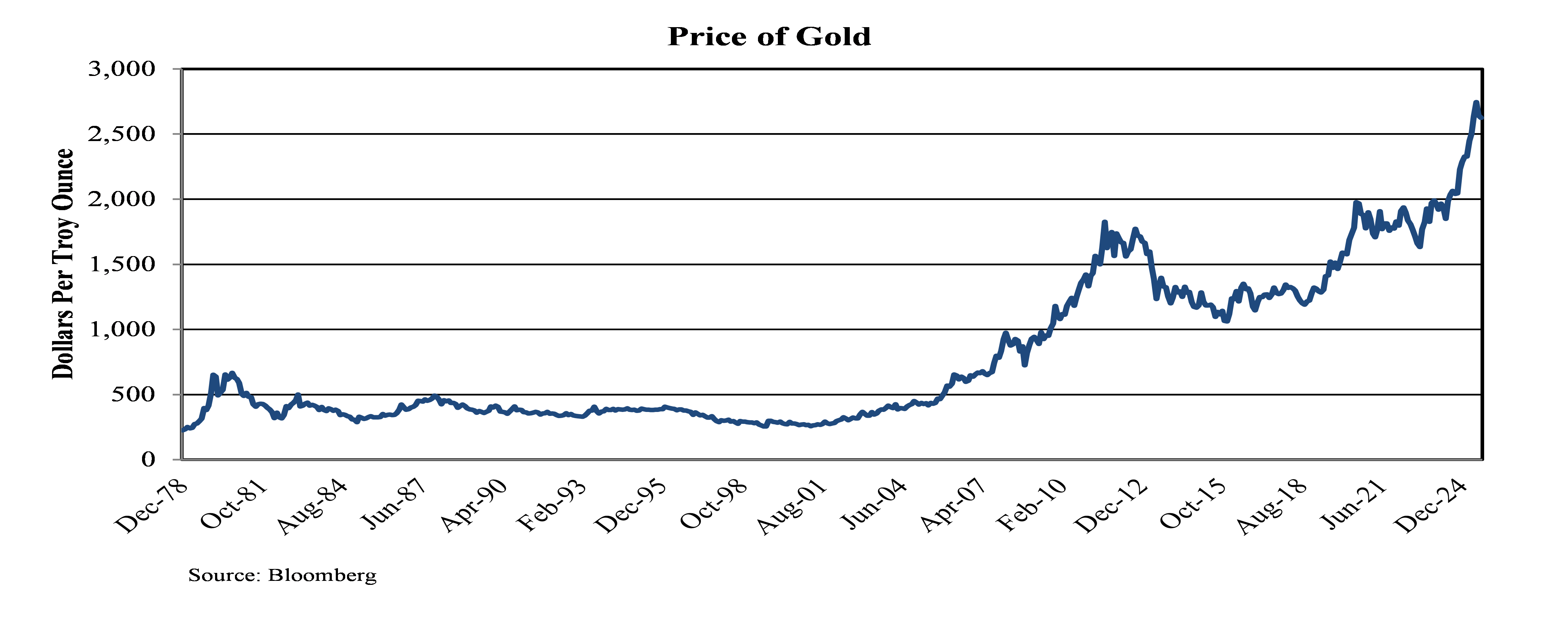

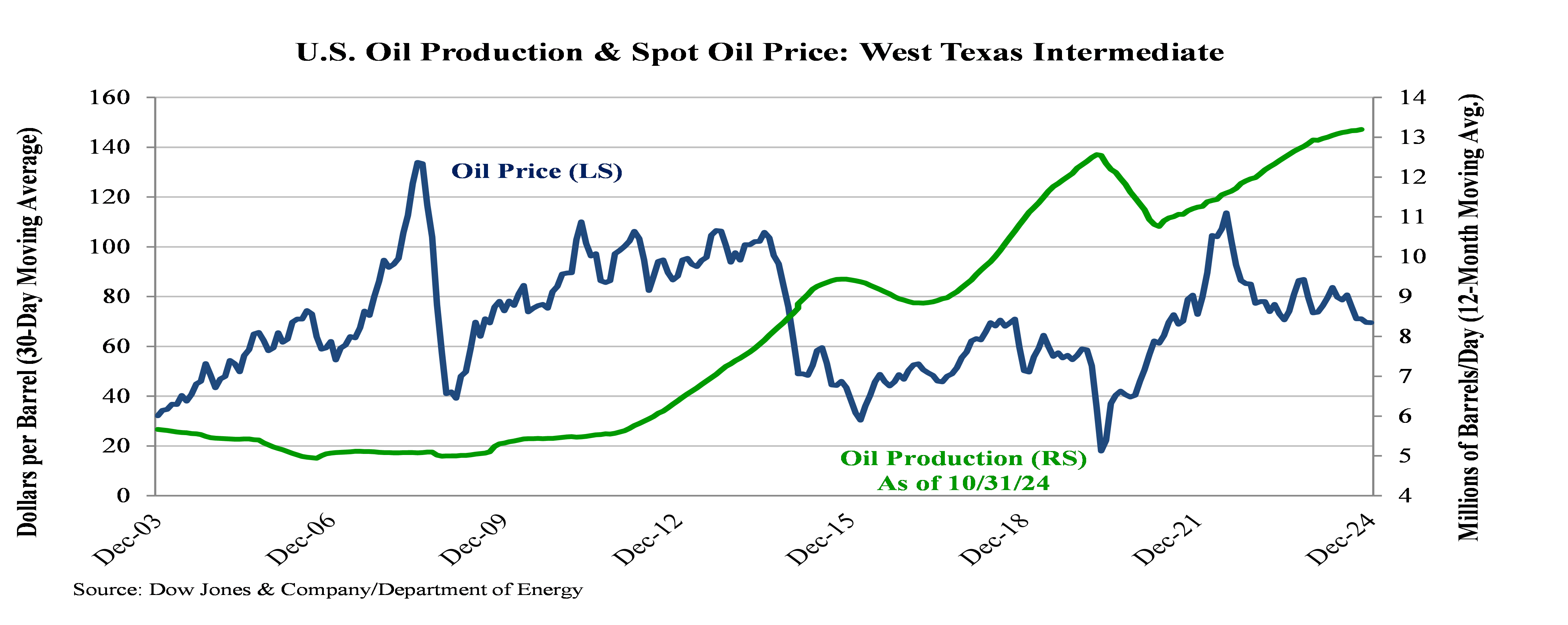

As in prior fourth-quarter reviews, we have included a compendium of economic and market-related charts.

LOOKING AHEAD TO 2025

The buoyant equity market following the November elections echoed the enthusiasm surrounding President Trump’s first term, reflected in record U.S. equity inflows during the final quarter of 2024. Following the 2017 inauguration, investor enthusiasm for policies, including the Tax Cuts and Jobs Act, led to a self-fulfilling cycle of rising equity prices, tightening credit spreads, and declining equity market volatility. However, this period of exuberance unwound in 2018 amid a surge in option-related volatility, trade war headlines, and a hawkish Federal Reserve. These key themes from 2018 may similarly impact the economy and equity market this year.

A surge in options activity precipitated a 4.1% one-day decline in the Standard & Poor’s 500 Index in February 2018 following an extended period of historically low equity market volatility. While we may not see the exact replay of that experience, the market has recently enjoyed a period of historically low volatility at a time when investment flows into levered ETFs and zero-day options have reached record levels. We believe low equity market volatility over the past twelve months will likely revert to historical levels in the coming year. Investors have enjoyed sanguine markets primarily because of the expectation in the first part of 2024 that the Fed would cut interest rates in response to disappointing economic data. This created a unique market environment in which “bad” economic news was “good” news for the stock market. To the extent that much good news is now priced into the equity market, any market sell-off could be amplified by the recent increased investment in leveraged investments.

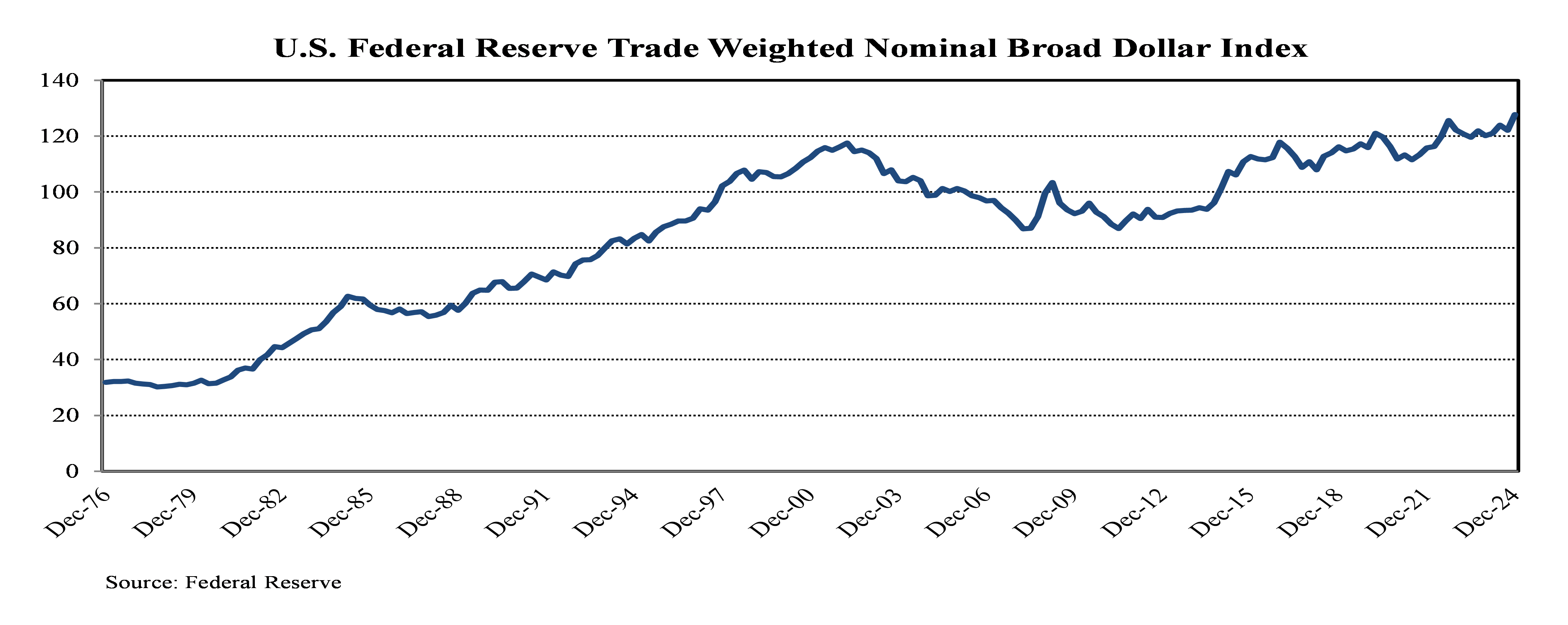

In 2018, global financial markets were blindsided by the Trump Administration’s decision to launch a trade war with China and multiple U.S. allies. President-elect Trump made tariffs a cornerstone of his reelection bid. It is reasonable to assume that tariffs will be a primary tool of the administration’s playbook of “escalating to de-escalate” negotiations to extract concessions. In Trump’s ideal scenario, tariffs will offset lower tax revenues and prevent the federal deficit from widening. However, tariffs only raised $84 billion in customs duties in the fiscal year that ended in September 2024, representing 1.6% of total federal receipts. This compares to tax revenues from individual income ($4.9 trillion, 49%), payrolls ($1.7 trillion, 34%), and corporations ($530 billion, 11%). We are optimistic that tariffs can protect key national security and economic industries. However, we believe it is unlikely that tariffs can raise meaningful amounts of revenue to blunt the burgeoning deficit. Details related to these potential policy shifts are in short supply, which increases the potential for an unexpected policy shock.

The third parallel 2025 may hold with 2018 is the recently hawkish Federal Reserve. The Federa Funds futures market is notoriously poor at forecasting the future path of the Federal Reserve’s benchmark interest rate. Yet, it remains a good barometer of where the market believes interest rates may go in the short run. One year ago, the futures market pointed to seven quarter-point interest rate cuts in 2024, with the first expected in March 2024. However, stronger-than-anticipated economic growth and stubbornly firm inflation readings pushed out the first interest rate cut until September. The market was somewhat surprised when the Federal Reserve reduced its benchmark rate by half a percentage point rather than a quarter-point. Quarter-point reductions followed the September cut in November and December. Following the recent December meeting, the Federal Reserve updated its forecast to include only two interest rate cuts in 2025.

The current business cycle continues to behave in nontraditional ways, including the context for interest rate cuts. The Federal Reserve has not reduced interest rates over concern of a looming recession, which is the typical motivation for such action. The economy is growing well above its long-term potential and accelerated in last year’s second and third quarters. What’s remarkable is that, despite the central bank’s aggressive rate hikes from 0.25% to 5.50% and prolonged tight monetary policy, inflation has cooled significantly without dragging the economy into recession. Instead, the economy continues to expand at an above-average pace – a historically rare outcome. Typically, faster economic growth pushes long-term yields higher, while recession lowers them. When the Federal Reserve begins cutting interest rates, it usually signals a recession, and long-term yields tend to decline as the bond market anticipates the economic slowdown. In this cycle, however, the Federal Reserve reduced rates amid strong GDP growth.

In an unusual move, the yield on the 10-year Treasury has risen roughly 1.00% over the period the Federal Reserve has been cutting interest rates by a total of 1.00% since September 2024. The lift in long-term yields reflects growing concern that stimulative fiscal policies and additional tariffs will further fuel inflation. Moreover, a flood of new Treasury issuance will be required to sustain enormous deficit spending. As a result, equity investors are likely to keep a keen eye on the behavior of the bond market in 2025. If 10-year Treasury yields rise much above 5.0%, from 4.6% currently, it will likely prove a headwind to stock valuations. Such a move in yields would also push mortgage rates back towards 8.0%, further crimping home affordability.

Key issues for the year ahead include proposed policy changes to tariffs, immigration, taxes, and government employment and spending, which are all important components of economic growth and inflation. In contrast to 2016, Trump’s second term will begin with equity valuations, inflation, and interest rates at much higher levels. Despite probably choppier waters ahead, the economy and equity market enjoy considerable momentum as we enter the new year. Corporate earnings are forecast to grow 12% in the coming year, an acceleration from roughly 9% in 2024. Notably, the earnings growth differential between the eight large technology companies and the remaining 492 stocks in the Standard & Poor’s 500 Index is set to narrow significantly in 2025. This narrower differential should contribute to a broadening of equity participation over time.

FINANCIAL MARKET TOTAL RETURN*

Michael C. Yeager, CFA

January 7, 2025

IMPORTANT INFORMATION

The commentary set forth herein represents the views of Luther King Capital Management and its investment professionals at the time indicated and is subject to change without notice. The commentary set forth herein was prepared by Luther King Capital Management based upon information that it believes to be reliable. Luther King Capital Management expressly disclaims any responsibility to update the commentary set forth herein for any events occurring after the date indicated herein or otherwise.

The commentary and other information set forth herein do not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor do they constitute investment advice or an offer to provide investment advisory or other services by Luther King Capital Management. The commentary and other information contained herein shall not be construed as financial or investment advice on any matter set forth herein, and Luther King Capital Management expressly disclaims all liability in respect of any actions taken based on the commentary and information set forth herein.