Executive Summary:

International equity markets declined during the fourth quarter, as optimism faded with weaker data from many of the G7 nations and higher long rates.

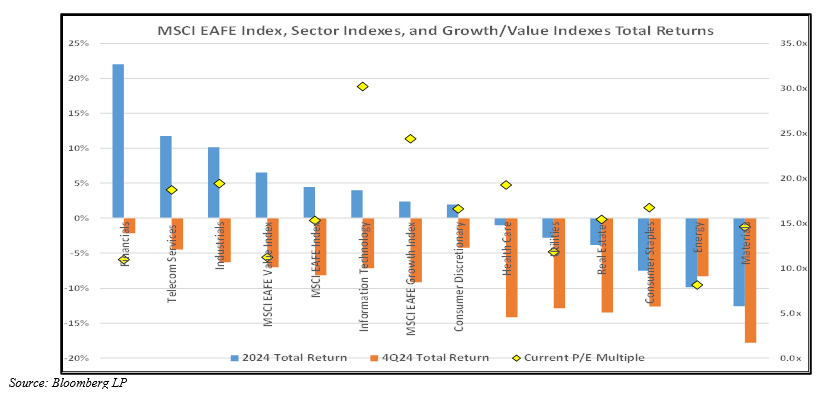

The overall MSCI EAFE Index declined by 8.1% during the quarter, while value continued to outperform growth by ~200bps. The index returned 4.4% for the 2024, while value sub-index outperformed growth by ~415bps for the year.

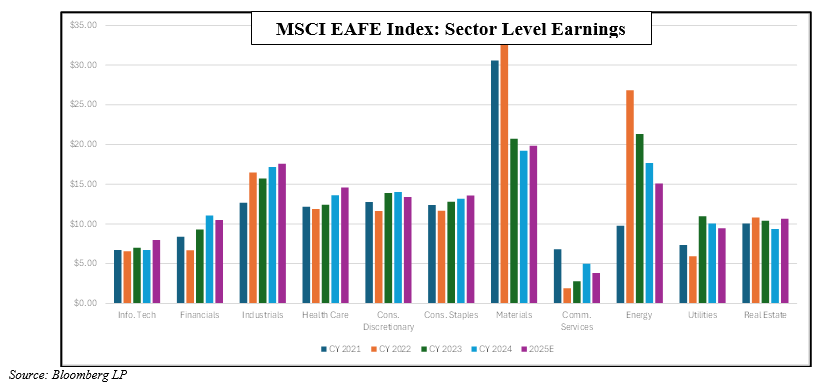

Financials sector stood out as the outperformer for both the quarter and year, nearly doubling performance of the second-best performing sector, Telecommunications Services. The worst performing sector for both the quarter and year was Materials.

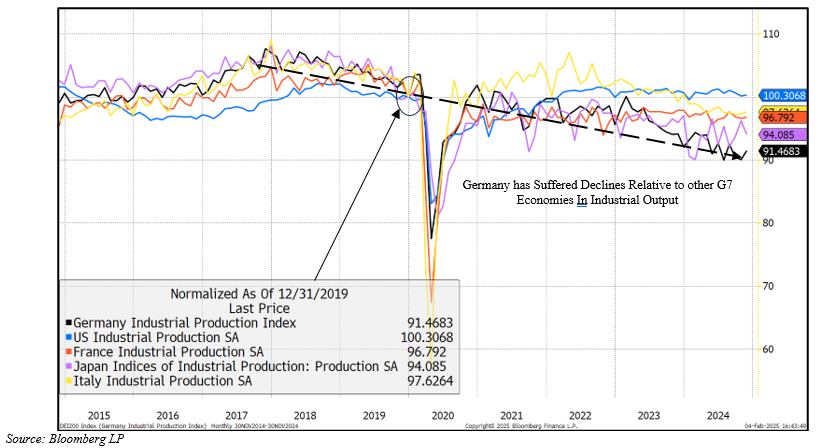

Germany continues to suffer from a failed recovery in industrial output with two consecutive years of negative real economic growth. France and Italy also decelerated in 2024, raising risks of broader economic weakness. Smaller members of the union – Spain, Portugal, Greece, etc – exhibited more substantial real growth.

The United Kingdom also showed weak economic growth and persistent inflation. While they struggle with appropriate policy response, the Bank of England has less flexibility to respond until inflation trends lower.

China claimed 5% real GDP growth during 2024, but weaker data belies this headline strength. Capital continues to flow away from their markets, measured by both purchase of equity securities and foreign direct investments. Debt continues to climb to levels that raises risks in their credit system.

China continues to suffer from excess capacity, and earnings losses mounted during 2024 for publicly traded equities.

Japan saw negative real GDP growth in 2024, as they continue to see weak domestic consumption and disappointing industrial output. Elevated inflation and weak currency forced Japan to raise rates while other central bankers reduced rates.

Canada has been the most aggressive G7 country in monetary response. Inflation has plummeted while unemployment has risen, allowing for greater flexibility, despite real economic growth remaining in positive territory.

We expect to see better conditions, barring trade wars or other geopolitical risk, starting to develop as we move through the year.

Economic and Capital Markets Commentary:

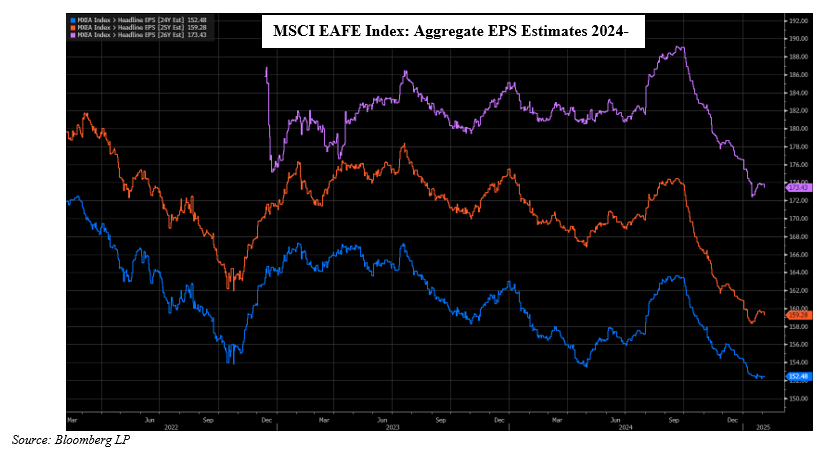

The international markets, as represented by the MSCI EAFE Index, decreased by 8.1% during the quarter, though still increasing by 4.4% during 2024. Price action during the quarter reflects the cautious tone struck by capital markets as economic stress persisted and activity stalled in Europe. During the last quarter of the year, analysts revised their forecasts for earnings growth. After these revisions, headline earnings growth in 2025 is only expected to be 4.6% for the aggregate in this index. Expectations now hinge heavily upon building momentum throughout this year and recognizing greater earnings contributions from a healthier economy forecast for the latter half of 2025 and into 2026.

Financials, Telecommunications, and Industrials led sector performance in 2024. Financials and Telecommunications were also two of the three best performing sectors in the fourth quarter, despite all sectors recording negative returns. These two sectors also supported the outperformance of the MSCI EAFE Value Index relative to the MSCI EAFE Growth Index for both the quarter and year. Economically sensitive markets in Energy and Materials contributed to these sectors posting the lowest returns for the year. Multiples remain elevated for Information Technology, contemplating the growth prospects in this sector, which remain greater than the aggregate Index. Despite enthusiasm for growth in this sector, international technology companies saw much greater revisions downward than their U.S. peers.

The European Union struggled to build any economic momentum in 2024 with real GDP growth of only 0.1% during the fourth quarter, a dramatic slowdown from the more buoyant 0.4% in the third quarter. Germany continues to struggle, posting only 0.1% in real GDP growth over the last five years. Their historical competitive advantages in manufacturing have deteriorated, resulting from increased labor, energy, and regulation costs, as competitors in other countries – specifically, China – have flexed. Capital formation has also declined, as capacity utilization runs at a paltry 76%, which typically ranges from 82-88% outside of recessions. As such, capital investments, which have shown annual declines for seven quarters, have also dragged down GDP growth. In the face of the structural headwinds, estimates for GDP growth remain very weak despite two years of declines. The country appears to be at a critical juncture, and the political turmoil with the rise of more populist and conservative parties will likely reshape some of the policies in upcoming elections later this month, where Chancellor Sholz’s party currently only polls at approximately 16%.

While Germany remains the sickest neighbor on the block, most European economies continue to struggle to find solid economic footing. Germany, Italy, and France – the three largest E.U. economies and ~50% of aggregate GDP for the 27 member states – continue to post anemic, if any, growth with the most recent quarter and exhibiting further deceleration. The United Kingdom has shown similar patterns but maintains a slightly better outlook for both the current year and next year’s real GDP growth (0.8-1.2% range). Smaller members, such as Spain and Greece, are forecast to outperform these larger peers, though have limited impact. Economic weakness, easing labor markets, and declining inflation rates have prompted actions by the European Central Bank (ECB) and the Bank of England (BOE). Inflation remains stickier in the United Kingdom, likely limiting their ability to respond, while the gauges for inflation have approached the ranges for the ECB to allow greater flexibility. This bank has decreased their policy rate by 125bps to 2.75% since June, whereas the BOE has reduced its policy rate by 50bps to 4.75%.

For Japan, economists forecast slightly negative annual real GDP growth during 2024, with growth forecast to accelerate to ~1.2% in 2025. The services sector has supported growth, while industrial production is estimated to have fallen ~4% over the last two years. Public spending and private investments contributed favorably. Prices in the economy have risen annually by an unexpected 3.0% during December, prompting the Bank of Japan to raise rates further in January. This central bank started raising rates in early 2024, breaking nearly a decade of negative rates in response to persistent price inflation. Japan will likely continue a gradual recovery throughout the year, but its growth relies upon improvements in both domestic consumption and foreign demand.

China remains a major force for trends in global growth, and they have remained a disruptor. Beijing states its economy expanded by 5% last year, but a variety of weak indicators have made third-party economists dubious of the claim. This rate from their National Bureau of Statistics coincidentally hit the exact target stated by the Chinese Communist Party. Weak consumer inflation, tax revenue, bank lending, retail sales, and online spending contrast with the headline strength. Additionally, the economy remains further anchored by a persistent slump in real estate, which has led to the destruction of an estimated $18 trillion in Chinese household wealth, surpassing losses suffered by Americans in the financial crisis of 2008-09. A possible explanation for GDP growth could be an acceleration of economic activity after Chinese authorities introduced a flood of monetary and fiscal stimulus in late September. While this acceleration holds some optimism for a recovery, doubt remains about the durability of this bounce. The capital markets still exhibit concerns, as the equity markets and currency continued to show weakness through yearend. Chinese A-share equity funds saw a net outflow of $4.4bn in 2024 after outflows of $2.6bn in 2023, while data for monthly foreign direct investments showed a decline of ~$24bn through November.

Credit quality and total debt load have become a larger challenge for China, as they continue to pursue industrial policies through state subsidies and overcapacity. There remains a level of opacity around total debt in the system, raising concerns about the potential quality of this debt. Estimates for total debt-to-GDP ratios (public and private nonfinancial) have risen to 300%, but this estimate excludes the local government financing vehicles mentioned in prior letters, which would add ~50% more. Further much of the corporate debts is borrowed by state-owned-enterprises (“SOEs”), which tend to be poor creditors.

Overcapacity and weak export demand have led to the deterioration in the Producers’ Price Index. Chinese exports grew by 18% from 1990-2011, but since 2011, exports have averaged only 6% with an increased frequency of negative growth data. Nearly a quarter of the companies listed in mainland China reported net losses for the third quarter of 2024 – a new record and up from only 9% in 2018. Further, profit margins reached their lowest levels since 2009, according to FactSet index of 5,000 listed firms. Profit squeeze is adding to pressure as many managements shift towards cost-cutting: postponing investments, deferring wage increases, and reducing workforce. This response risks further undermining the strength of domestic private consumption, which is sorely needed to buoy GDP growth. The new wave of potential trade restrictions and tariffs – both by United States and European Union – adds additional risks to the industrial policy, which subsidizes manufacturing growth to take global market share. We expect that capital losses rise as businesses fail and losses mount. We expect that China will ultimately need to act to support domestic consumption and citizens.

Bank of Canada was the first G7 central bank to kick off the easing cycle, reducing rates initially in June. They have also been the most aggressive in this cycle, with six policy actions to reduce overnight lending rates by a cumulative of 250bps. They have taken more action to stimulate their economy through rate policy than any of their peers at this point in the cycle. Unemployment had risen by 200bps to 6.9% in November, though declined slightly in December and January. Core CPI plunged post-COVID to 1.7% in Q4 2024. Lower core inflation, higher unemployment, decelerating wage growth, and weak industrial output led to policy actions to stimulate the economy. While President Trump certainly poses a new risk to the USMCA trade block, Canada appears to be in a good position to benefit from any strength emanating from both the policy actions taken by the Bank of Canada and any spillover of growth from deregulation and tax policies in the United States. The politics in Canada reflects a similar shift as has occurred in the United States and many European nations, as more conservative populism rises. Loss of support and internal dissent within his party led to Prime Minister Trudeau’s resignation in January. While Canada has struggled over the last two years with deceleration in economic growth, we expect that they will the reverse trend to accelerate economic growth, supported by increased investments resulting from lower rates and improvement in industrial output.

Expectations for economic reacceleration continue to dominate the forecasts, though revisions have tempered some enthusiasm. While some exceptions exist, many of the G7 economies have been in a period of deceleration with some – Germany – being in prolonged recession. China continues to struggle with excess capacity, real estate crisis, weak domestic consumption, high debt loads, and decelerating export growth. Though they have lots of levers to pull, they may be approaching their “Icarus moment” as they continue to promote industrial policies that lead to high levels of capital losses. But, they have a command and control economy in which the central planners have great influence. Perhaps they can successfully avoid falling from grace.

Inflation continues to be sticky in some places and non-existent in others. Of the G7 nations, only Japan has raised rates over the last twelve months. China has also lowered rates in order to spur economic activity. These policy actions should reduce costs of capital and spur formation of new credit, leading to additional domestic investments and consumption. As Milton Freeman stated, “monetary changes have their effect only after a considerable lag and over a long period – and that lag is variable.” While not helpful on timing, it directionally points to a more constructive environment that ultimately develops under the current policy framework. We expect to see better conditions, barring trade wars or other geopolitical risk, starting to develop as we move through the year.

Mason D. King, CFA

February 10, 2025